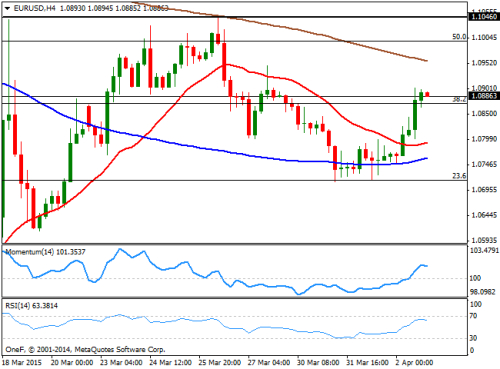

The EUR/USD advanced up to 1.0903 this Thursday, with not much behind the generalized dollar weakness, but position adjustments and lack of USD buyers ahead of the Nonfarm Payroll report, to be release early Friday. In fact, the data released earlier in the US surprised to the upside, with the Trade Balance showing the deficit shrank to $35.4 billion in February, whilst weekly unemployment claims decreased to a nine-week low of 268K in the week ended March 28. But dollar's advance following this first run of readings was seen by market as a chance to buy the pair that quickly advanced up to the 1.0865 price zone, before breaking through the key Fibonacci level, and extended up to the mentioned high.

The EUR/USD pair enters the new day, when most markets will remain closed on Good Friday, consolidating near the daily high and with the 1 hour chart showing that the technical indicators remain flat in overbought territory, and the price well above its moving averages, with the 200 SMA around 1.0865 the Fibonacci level, reinforcing the strength of the support. In the 4 hours chart the technical indicators maintain a strong upward momentum well above their mid-lines, whilst the 20 SMA is now losing its bearish slope well below the current level, all of which should keep the risk towards the upside in the short term.

Support levels: 1.0865 1.0820 1.0790

Resistance levels: 1.0900 1.0950 1.1000

This Report by

One Financial Market Company

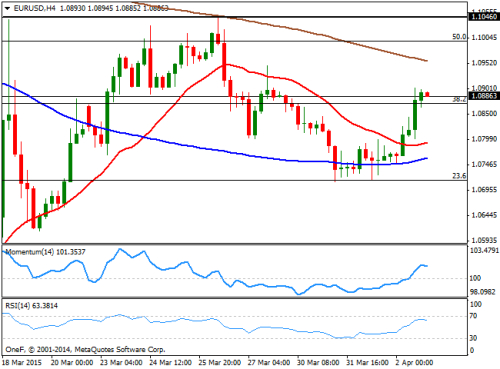

The EUR/USD pair enters the new day, when most markets will remain closed on Good Friday, consolidating near the daily high and with the 1 hour chart showing that the technical indicators remain flat in overbought territory, and the price well above its moving averages, with the 200 SMA around 1.0865 the Fibonacci level, reinforcing the strength of the support. In the 4 hours chart the technical indicators maintain a strong upward momentum well above their mid-lines, whilst the 20 SMA is now losing its bearish slope well below the current level, all of which should keep the risk towards the upside in the short term.

Support levels: 1.0865 1.0820 1.0790

Resistance levels: 1.0900 1.0950 1.1000

This Report by

One Financial Market Company