Full Report

Figure 3 represents the term structure of Dukascopy Bank Sentiment Index (Y-axis) mapped against the GDP growth forecasts made by poll respondents (X-axis). Overall, DBSI values and GDP growth forecasts match directionally, suggesting the global economy will perform better three years from now.In the coming six months Europe’s economy is projected to expand by 0.33%, the lowest rate this year, on the back of sticky inflation in the Euro area, deterioration in consumer sentiment and business climate, slowdown in manufacturing sectors in the core countries, and high unemployment rate. In order to stimulate the Euro zone’s economy and avoid a Japan-style deflationary spiral, the ECB decided to take unprecedented steps by introducing negative interest rates. The long term forecast hints at a slight growth of around 1.27%. Thus, the recent ECB actions have not still translated into strong optimism about the Euro area economic future.After striking negative GDP data out of the North America, experts have revised the region’s six-month and three-year growth outlook downwards, expecting a growth rate at 1.43% and 1.93% in the near term and in 2017, respectively.Meanwhile, optimism concerning Asia–Pacific economic stance spreads around the world, as the gauge of six-month growth rose from 3.20% in May to 3.80% in June, while the region’s economy is expected to grow at 4.13% in 2017.

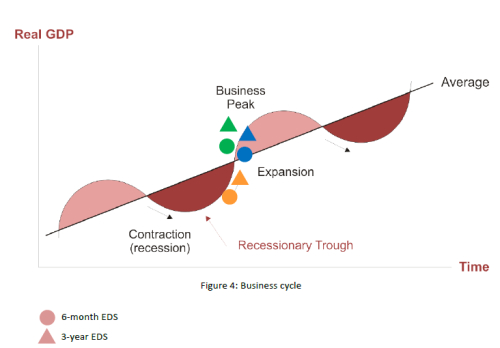

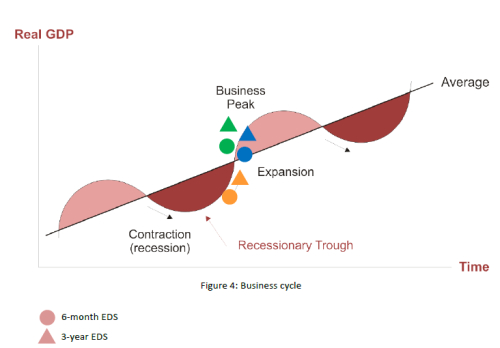

Figure 4 presents the business cycle and its phases: expansion (real GDP is increasing), peak (real GDP stops increasing and begins decreasing), contraction or recession (real GDP is decreasing), and trough (real GDP stops decreasing and begins increasing). While the North America and Asia-Pacific are rushing to reach the business peak, Europe is struggling to move up along the business cycle curve towards the expansion phase. As confidence in Asia-Pacific economy continues to increase, the distance to business peak is constantly shortening. In June the number of experts who see the region’s economy reaching the highest point in three-year time increased to 6 up from 3 seen last month. Meanwhile, North America is lagging behind, as weather-hit first quarter growth surprised to the downside. Nevertheless, 5 professors project the nations’ economy to reach business peak in 2017, compared to one expert in the May poll.

- June’s findings of Dukascopy Sentiment Index survey revealed that professors were particularly upbeat about the long term economic prospects. Europe enjoyed the biggest gain of confidence, with the corresponding index surging 0.12 points to the highest level this year. The gauge for the Asia-Pacific region also refreshed this year's high, skyrocketing 0.07 to 0.86. In contrast North America region saw its sentiment index inching slightly higher. All in all, optimism about global economic prospects grew 0.07 points in June to this year's high of 0.78.

- While professors share optimistic long term outlook for Europe, in the short-run they lost trust in the region’s economy, as the sentiment index slipped by 0.06 to 0.52, the level last seen in February. This might be due to the fact that the recent data out of Europe points to an uneven economic picture, with the core countries reporting disappointing numbers, while periphery continues to slowly recover. The long-term outlook might be supported by the recent decision of the ECB to enter the unchartered waters by launching negative interest rates. This measure is designed to bolster economic growth in the Euro zone and ensure inflation does not fall further.

- The recent data showed that the U.S. economy contracted in the first quarter, with GDP coming in at –2.9%, while Canada’s growth also disappointed. Apparently, this negative news weighed on experts short-term outlook, as the corresponding index lost 0.06 points. However, the long-term outlook is still optimistic.

- While Shizno Abe launches the “third arrow” and China shows signs of a rebound, RBNZ hike interest rates and the Australian growth surprises to the upside. All these have contributed to a gain in the short and long term sentiment indices.

Figure 3 represents the term structure of Dukascopy Bank Sentiment Index (Y-axis) mapped against the GDP growth forecasts made by poll respondents (X-axis). Overall, DBSI values and GDP growth forecasts match directionally, suggesting the global economy will perform better three years from now.In the coming six months Europe’s economy is projected to expand by 0.33%, the lowest rate this year, on the back of sticky inflation in the Euro area, deterioration in consumer sentiment and business climate, slowdown in manufacturing sectors in the core countries, and high unemployment rate. In order to stimulate the Euro zone’s economy and avoid a Japan-style deflationary spiral, the ECB decided to take unprecedented steps by introducing negative interest rates. The long term forecast hints at a slight growth of around 1.27%. Thus, the recent ECB actions have not still translated into strong optimism about the Euro area economic future.After striking negative GDP data out of the North America, experts have revised the region’s six-month and three-year growth outlook downwards, expecting a growth rate at 1.43% and 1.93% in the near term and in 2017, respectively.Meanwhile, optimism concerning Asia–Pacific economic stance spreads around the world, as the gauge of six-month growth rose from 3.20% in May to 3.80% in June, while the region’s economy is expected to grow at 4.13% in 2017.

Figure 4 presents the business cycle and its phases: expansion (real GDP is increasing), peak (real GDP stops increasing and begins decreasing), contraction or recession (real GDP is decreasing), and trough (real GDP stops decreasing and begins increasing). While the North America and Asia-Pacific are rushing to reach the business peak, Europe is struggling to move up along the business cycle curve towards the expansion phase. As confidence in Asia-Pacific economy continues to increase, the distance to business peak is constantly shortening. In June the number of experts who see the region’s economy reaching the highest point in three-year time increased to 6 up from 3 seen last month. Meanwhile, North America is lagging behind, as weather-hit first quarter growth surprised to the downside. Nevertheless, 5 professors project the nations’ economy to reach business peak in 2017, compared to one expert in the May poll.