It's hard to trade forex as any other markets based on the indicators without understanding the price action.

The better way is to apply simple and more predictable methods

The suggested trade approach is based on the channels and support and resistance lines. Do not look for fancy indicators, apply most evident easy to use tools.

1. Draw a channel on the main chart on H4 and a channel of the RSI indicator.

2. Do the same on H1. If the channels have the same direction, wait to join the trend. If they look opposite ways, be ready to jump the trade once the price reverses to the H4 trend.

3. Define support and resistance zones where a main H4 trend can end or a correction can occur.

4. Lets assume that the main trend is bouncing back from the support or resistance zone.

5. The safest way to enter the bounce trade is at the moment when price breaks the previous H1 channel line. The stop loss is above/below high/low of the original move. The target is the previos global support/resistance line on H4 chart.

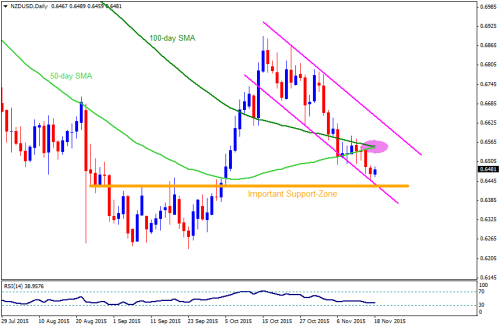

An example on the picture from Nov 2015. Look at the subsequent price action to figure out the details of the strategy. The price bounced back from the support line and returned to the previous support which became resistance

The most recently NZDUSD returned to the same support level at 0.645 level and rebounded. As a trade suggestion look to buy NZDUSD to go to the top of the range at 0.685

The better way is to apply simple and more predictable methods

The suggested trade approach is based on the channels and support and resistance lines. Do not look for fancy indicators, apply most evident easy to use tools.

1. Draw a channel on the main chart on H4 and a channel of the RSI indicator.

2. Do the same on H1. If the channels have the same direction, wait to join the trend. If they look opposite ways, be ready to jump the trade once the price reverses to the H4 trend.

3. Define support and resistance zones where a main H4 trend can end or a correction can occur.

4. Lets assume that the main trend is bouncing back from the support or resistance zone.

5. The safest way to enter the bounce trade is at the moment when price breaks the previous H1 channel line. The stop loss is above/below high/low of the original move. The target is the previos global support/resistance line on H4 chart.

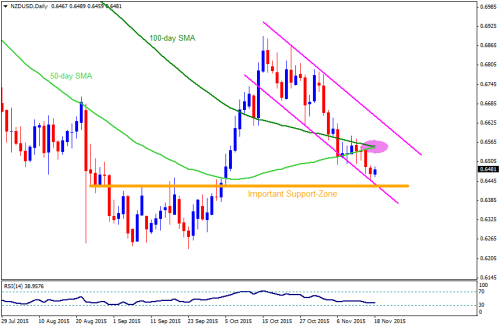

An example on the picture from Nov 2015. Look at the subsequent price action to figure out the details of the strategy. The price bounced back from the support line and returned to the previous support which became resistance

The most recently NZDUSD returned to the same support level at 0.645 level and rebounded. As a trade suggestion look to buy NZDUSD to go to the top of the range at 0.685