The U.S. dollar was seen trading mixed on Monday. Economic data was supportive of the greenback. The U.S. retail sales report showed that headline retail sales increased 0.5% on the month while core retail sales rose 0.4%.

The U.S. Empire State Manufacturing index was seen rising to 22.6 on the index, up from 20.3 which was forecast but lower than 25.0 from the previous report.

In the overnight trading session, the quarterly inflation report from New Zealand showed that consumer prices advanced at a pace of 1.5% annually. On a quarterly basis, consumer prices rose 0.4% missing estimates of a 0.5% increase.

Looking ahead, the BoE Governor Mark Carney is scheduled to speak today. His speech comes ahead of the monthly labor market report. The UK's unemployment rate is expected to remain steady at 4.2% while wage growth is forecast to rise at a steady pace of 2.5%.

The NY trading session will see the Fed Chair Powell's testimony to Congress. Investors will be looking to see if the Fed Chair maintains his hawkish views on the economy. The U.S. industrial production and capacity utilization rate is also expected to be released.

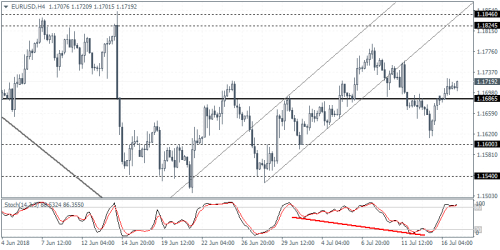

EUR/USD intra-day analysis

EUR/USD

EUR/USD

1.1737+0.0027 (+0.23%)

04:45:15 - Real-time Data

1.173610:0012:001.17001.17201.17401.17101.1730

Technical Summary

5 mins: Strong Buy

Hourly: Strong Buy

Daily: Strong Buy

Monthly: Sell

What is your sentiment on EUR/USD?

or

(1.1719):The euro was seen extending the gains on Monday against the U.S. dollar. Despite a strong patch of economic releases, the euro managed to rise to intraday highs of 1.1725. Price action has now cleared the support/resistance level of 1.1686. This is expected to keep the bias to the upside. Any dips are likely to stall back near the 1.1686 level. The currency pair is now likely to attempt to rally toward the next main resistance level at 1.1960 - 1.1920 level.

The U.S. Empire State Manufacturing index was seen rising to 22.6 on the index, up from 20.3 which was forecast but lower than 25.0 from the previous report.

In the overnight trading session, the quarterly inflation report from New Zealand showed that consumer prices advanced at a pace of 1.5% annually. On a quarterly basis, consumer prices rose 0.4% missing estimates of a 0.5% increase.

Looking ahead, the BoE Governor Mark Carney is scheduled to speak today. His speech comes ahead of the monthly labor market report. The UK's unemployment rate is expected to remain steady at 4.2% while wage growth is forecast to rise at a steady pace of 2.5%.

The NY trading session will see the Fed Chair Powell's testimony to Congress. Investors will be looking to see if the Fed Chair maintains his hawkish views on the economy. The U.S. industrial production and capacity utilization rate is also expected to be released.

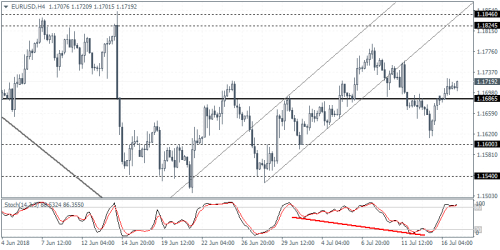

EUR/USD intra-day analysis

EUR/USD

EUR/USD

1.1737+0.0027 (+0.23%)

04:45:15 - Real-time Data

1.173610:0012:001.17001.17201.17401.17101.1730

Technical Summary

5 mins: Strong Buy

Hourly: Strong Buy

Daily: Strong Buy

Monthly: Sell

What is your sentiment on EUR/USD?

or

(1.1719):The euro was seen extending the gains on Monday against the U.S. dollar. Despite a strong patch of economic releases, the euro managed to rise to intraday highs of 1.1725. Price action has now cleared the support/resistance level of 1.1686. This is expected to keep the bias to the upside. Any dips are likely to stall back near the 1.1686 level. The currency pair is now likely to attempt to rally toward the next main resistance level at 1.1960 - 1.1920 level.