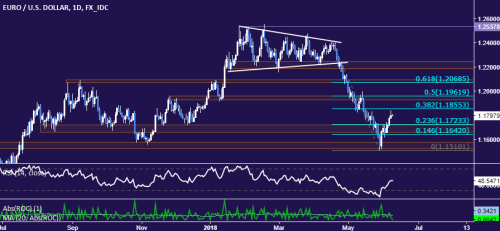

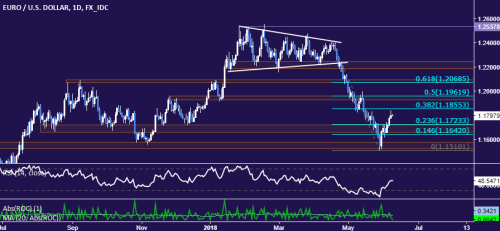

The Euro has mounted a spirited recovery against the US Dollar since finding a bottom near the 1.15 figure but the overall trend points firmly lower. Turning to the monthly chart, recent gains appear to be corrective within the confines of a decade-long decline resumed in early May.

Sizing up immediate positioning, prices are poised to test the 38.2% Fibonacci retracement at 1.1855. A break above that confirmed on a daily closing basis exposes the 1.1930-62 area, a congestion region reinforced by the 50% level. Near-term support is in the 1.1642-1.1723 zone.

The EUR/USD short position initiated at 1.2407 and subsequently scaled up above the 1.19 figure remains in play, with the upswing viewed as an opportunity to build short exposure further once trend resumption is confirmed. The net cost basis is 1.2276. A stop-loss will be triggered on a discretionary basis.

Sizing up immediate positioning, prices are poised to test the 38.2% Fibonacci retracement at 1.1855. A break above that confirmed on a daily closing basis exposes the 1.1930-62 area, a congestion region reinforced by the 50% level. Near-term support is in the 1.1642-1.1723 zone.

The EUR/USD short position initiated at 1.2407 and subsequently scaled up above the 1.19 figure remains in play, with the upswing viewed as an opportunity to build short exposure further once trend resumption is confirmed. The net cost basis is 1.2276. A stop-loss will be triggered on a discretionary basis.