Hi,

Gold has been under the spotlight this year after it finally managed to breakout of its bearish cycle started since 2011 high. The secular cycle still remains bullish for gold price, unless we're really entering a stagnation period with deflate prices which has really low odds of happening due to the fact that the whole commodity complex is entering into a bullish cycle. Climate changes and the supply-demand imbalances will keep the commodities higher and if all commodities are moving up, Gold will follow as well.

What about Gold in 2016?

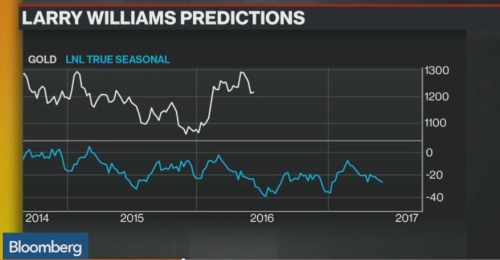

Well, that's another story. with commercials (hedgers) holding record amounts of shorts and the prospect of further tightening in the US interest cycle this will keep the Gold prices in a more balanced position and we should see some pullbacks that will produce sharp rallies but all inside a broader ranging market. In Figure above we have Larry Williams' prediction for the gold which I tend to agree with not just because I respect Larry's analysis and his insights but because that's what my price reading tells me.

We really need some bigger disruptive forces to dislocate Gold prices and inspire more bullishness at this point.

Best Regards,

Daytrader21

Gold has been under the spotlight this year after it finally managed to breakout of its bearish cycle started since 2011 high. The secular cycle still remains bullish for gold price, unless we're really entering a stagnation period with deflate prices which has really low odds of happening due to the fact that the whole commodity complex is entering into a bullish cycle. Climate changes and the supply-demand imbalances will keep the commodities higher and if all commodities are moving up, Gold will follow as well.

What about Gold in 2016?

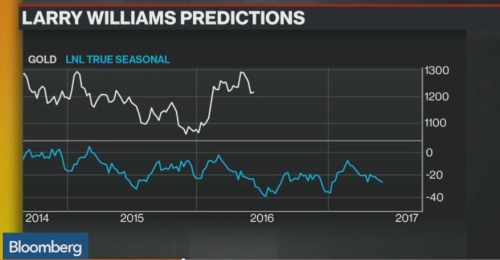

Well, that's another story. with commercials (hedgers) holding record amounts of shorts and the prospect of further tightening in the US interest cycle this will keep the Gold prices in a more balanced position and we should see some pullbacks that will produce sharp rallies but all inside a broader ranging market. In Figure above we have Larry Williams' prediction for the gold which I tend to agree with not just because I respect Larry's analysis and his insights but because that's what my price reading tells me.

We really need some bigger disruptive forces to dislocate Gold prices and inspire more bullishness at this point.

Best Regards,

Daytrader21