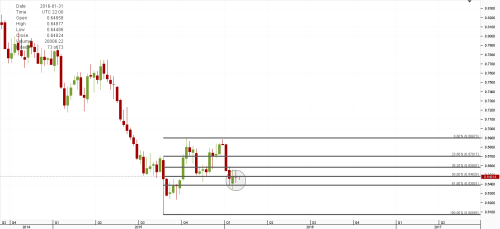

In Weekly Chart, NZD/USD has extended its recovery to the 61.8% Fibonacci retracement of its August-October (2015) rally and it is trading near 0.648 level with 50% Fibonacci.

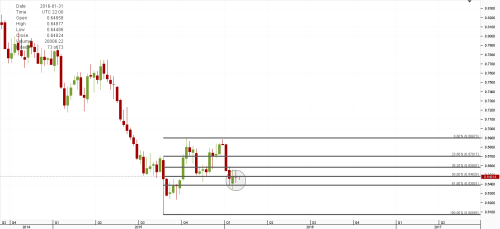

In Daily Chart, The MACD is flat-lining, but still well below the “0” level, signaling bearish momentum. Meanwhile, the RSI has bounced from oversold territory but still remains in bearish territor. So you could make a case for a near-term recovery

Given the technical signals, NZD/USD is near-term movement will likely hinge on global risk sentiment: if major risk assets (oil) are able to extend the current rally. On the other hand, a resumption of the risk averse trading that characterized the first 2-3 weeks of the year could take NZD/USD through 0.638 (61.8% fib) support to retest its lows.

In Daily Chart, The MACD is flat-lining, but still well below the “0” level, signaling bearish momentum. Meanwhile, the RSI has bounced from oversold territory but still remains in bearish territor. So you could make a case for a near-term recovery

Given the technical signals, NZD/USD is near-term movement will likely hinge on global risk sentiment: if major risk assets (oil) are able to extend the current rally. On the other hand, a resumption of the risk averse trading that characterized the first 2-3 weeks of the year could take NZD/USD through 0.638 (61.8% fib) support to retest its lows.