This is just and extracted post from my latest article which you can find it here: Greece next Lehman Brothers Event?

They say the Black Swan events are characterized by rarity and extreme impact and once again the financial markets are proving this to be wrong as theory has nothing to do with reality. Not so long ago we had the SNB event which disrupted the market activity than we had the 10 May Flash Crash, and the Bond Market flash Crash. Can Grexit be the catalyst for the next black swan event? Sure it can, however the probabilities are much more less to happen but that doesn't mean we won't have risk aversion as portfolio re-allocations and re-positioning of market participants in case of a such event will produce some volatility.

If you ask me I think the euro will rally after an initial sell off- knee jerk reaction, because the euro will be better off without Greece in the first place.

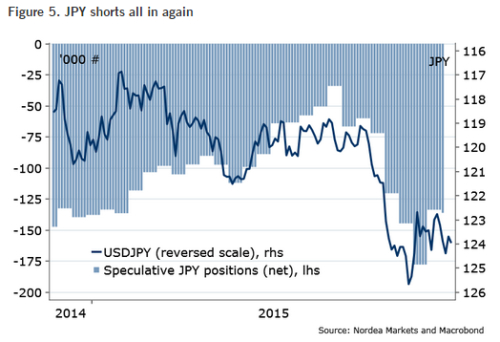

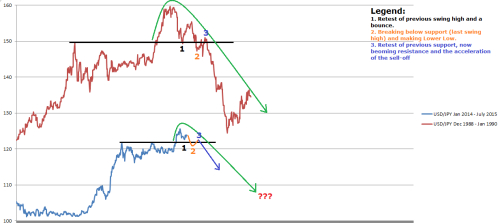

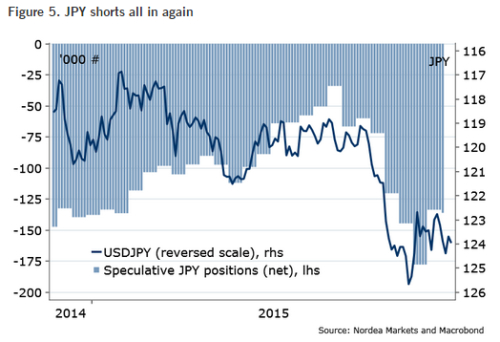

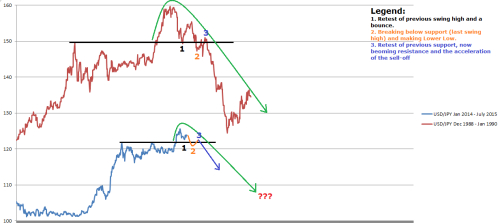

It couldn't be a better timing for the short JPY speculative positions to have been re-established and to use it as an contrarian indicator. The main driver behind this bullishness are the hopes of Fed interest rate normalization and global rates going higher, which it may be proven a wrong beat if risk aversion scenario kicks in. Direct comparison between USD/JPY now and in 1990 supports the idea of risk aversion scenario.

It couldn't be a better timing for the short JPY speculative positions to have been re-established and to use it as an contrarian indicator. The main driver behind this bullishness are the hopes of Fed interest rate normalization and global rates going higher, which it may be proven a wrong beat if risk aversion scenario kicks in. Direct comparison between USD/JPY now and in 1990 supports the idea of risk aversion scenario.

Also the yen seasonality provides an optimal context for the thesis of severe risk aversion and has supported recent rally started from May through Jun which is typically weak for Yen or bullish USD/JPY. However the same seasonality chart points for a reversal and stronger Yen starting from beginning of August.

What is really interesting and helpful is that back in the 90's Nikkei 225 was leading USD/JPY and broke lower ahead of any move in USD/JPY which highlights massive volatility in USD/JPY and a potential reversal. It is no coincidence then that USDJPY has maintained a remarkable similarity to the Nikkei in the late 1980's for the last 2.5 years. This shows that both USDJPY and Nikkei have also entered the last stages. There are many different styles of trading, but taking in consideration the volatility of this market now and in the 90's there are numbers of reasons and clear triggers to suggest why I'm waiting for more aggressive shorts.

Please go read the entire article here: Greece next Lehman Brothers Event?

Best Regards,

Daytrader21

- FX Market - Risk Aversion

Markets have consistently experienced " 100-year events" every five years. Paul Tudor Jones

They say the Black Swan events are characterized by rarity and extreme impact and once again the financial markets are proving this to be wrong as theory has nothing to do with reality. Not so long ago we had the SNB event which disrupted the market activity than we had the 10 May Flash Crash, and the Bond Market flash Crash. Can Grexit be the catalyst for the next black swan event? Sure it can, however the probabilities are much more less to happen but that doesn't mean we won't have risk aversion as portfolio re-allocations and re-positioning of market participants in case of a such event will produce some volatility.

If you ask me I think the euro will rally after an initial sell off- knee jerk reaction, because the euro will be better off without Greece in the first place.

- Grexit A Case for JPY Crosses

It couldn't be a better timing for the short JPY speculative positions to have been re-established and to use it as an contrarian indicator. The main driver behind this bullishness are the hopes of Fed interest rate normalization and global rates going higher, which it may be proven a wrong beat if risk aversion scenario kicks in. Direct comparison between USD/JPY now and in 1990 supports the idea of risk aversion scenario.

It couldn't be a better timing for the short JPY speculative positions to have been re-established and to use it as an contrarian indicator. The main driver behind this bullishness are the hopes of Fed interest rate normalization and global rates going higher, which it may be proven a wrong beat if risk aversion scenario kicks in. Direct comparison between USD/JPY now and in 1990 supports the idea of risk aversion scenario.

Also the yen seasonality provides an optimal context for the thesis of severe risk aversion and has supported recent rally started from May through Jun which is typically weak for Yen or bullish USD/JPY. However the same seasonality chart points for a reversal and stronger Yen starting from beginning of August.

What is really interesting and helpful is that back in the 90's Nikkei 225 was leading USD/JPY and broke lower ahead of any move in USD/JPY which highlights massive volatility in USD/JPY and a potential reversal. It is no coincidence then that USDJPY has maintained a remarkable similarity to the Nikkei in the late 1980's for the last 2.5 years. This shows that both USDJPY and Nikkei have also entered the last stages. There are many different styles of trading, but taking in consideration the volatility of this market now and in the 90's there are numbers of reasons and clear triggers to suggest why I'm waiting for more aggressive shorts.

Please go read the entire article here: Greece next Lehman Brothers Event?

Best Regards,

Daytrader21