The dollar strength has been well supported recently and this is due mainly because of the Fed rate expectations. However this week the market will focus again on the US labor figures which based on market expectation we should see further improvement in the labor market.

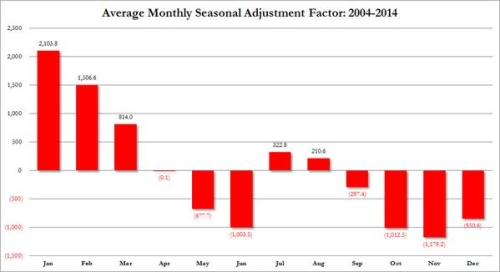

The dollar strength has been well supported recently and this is due mainly because of the Fed rate expectations. However this week the market will focus again on the US labor figures which based on market expectation we should see further improvement in the labor market.I'm expecting that February payrolls will surprise positively due to the seasonality tendencies which shows the average February NFP seasonal adjustment over the past decade to 1.5M jobs(see Figure

1). The market will always fall towards it's mean reversion and as such I'm expecting a better number.

NFP figures to keep an eye on:

- Previous: 257k;

- Forecast: 240K;

Figure 1. Average Monthly Seasonal Adjustment Factor: 2004-20014

NFP has been consistently one of the most decisive indicator to incorporate in to the "rate hike expectation" and this is the reason why it matters more now. Over the past years NFP figures had an asymmetric influence upon EUR/USD as better than expected figures prompts a larger negative reaction than their positive counterparts. The average reaction on EUR/USD is around 80 pips

Best Regards,

Daytrader21