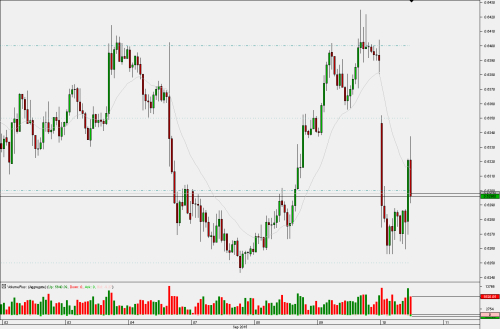

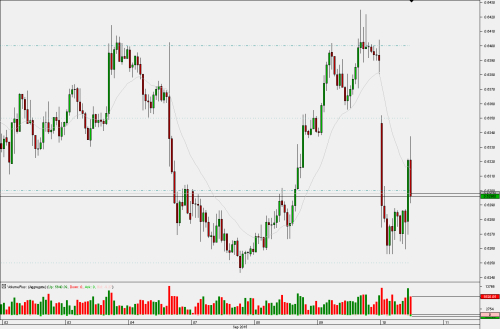

RBNZ cut Official Cash Rate to 2.75% from 3.00%, which was in line with expectations. However, the tone in the rate statement was more dovish than expected, reaffirming that "some further easing seems likely" and that "further NZD depreciation is appropriate". Kiwi was marked down immediately and continued to fall in the aftermath of the release, before pulling back in the early European session.

Resistance is seen at 0.6335 - 0.6340 (Previous Day Low, Weekly Pivot Point, 50.0% retracement of the fall since yesterday, H1 200 SMA, H4 50 SMA) and then at 0.6350 - 0.6360 (50's, Daily Support 1, Yesterday's European session low). Some demand seems to start coming in below 0.63 at the moment. If the pair breaks lower, July 2009 (0.6196) and June 2009 (0.6152) lows are the potential support levels.

Resistance is seen at 0.6335 - 0.6340 (Previous Day Low, Weekly Pivot Point, 50.0% retracement of the fall since yesterday, H1 200 SMA, H4 50 SMA) and then at 0.6350 - 0.6360 (50's, Daily Support 1, Yesterday's European session low). Some demand seems to start coming in below 0.63 at the moment. If the pair breaks lower, July 2009 (0.6196) and June 2009 (0.6152) lows are the potential support levels.