Tomorrow's ECB meeting can be the most important event of the year for euro as low inflation threats can be an obstacle to EU recovery.

Tomorrow's ECB meeting can be the most important event of the year for euro as low inflation threats can be an obstacle to EU recovery. The President of the European Central Bank Mario Draghi has already signaled the fact that ECB is ready to take action at today's meeting including both conventional and unconventional measures.

What to expect from tomorrow's ECB meeting?

Although the stimulus expectation has certainly picked up, however we can't look at just one aspect, and interest rates are one of those stimulus that come into play at today's meeting and it seems almost certainly that ECB will cut what it has left of its main interest rate in June and push the deposit rate below zero in an attempt to stop the euro from rising and inflation from falling any further.

Market expectation:

- Refi rate to be cut by 15bps to 0.1%;

- Deposit rate from zero to -0.15%;

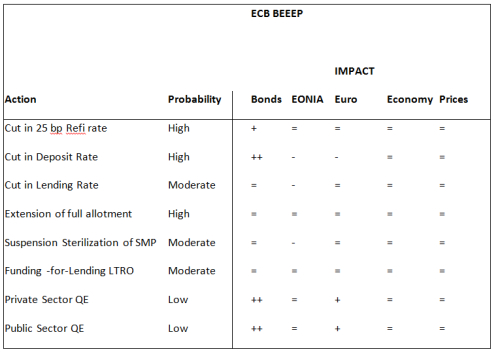

- The market also expects some form of credit easing, with another LTRO, the elimination of SMP sterilization and even broad-based QE all on the table.

Figure 1. Different market reaction to different change in ECB monetary policy action.

Cutting the interest rate on deposits below its current level of zero to -0.1 percent, means that ECB will be charging banks to park their cash at the ECB. So this in theory will force Bank to lend more rather than to have to pay to park their money at the ECB so this will grow the money supply and thus weaken the euro.

There is one important question that we must ask if the ECB outcome to do some easing has been already priced in?

The demand in the peripheral bonds has been slowed down, which was one of the factor that has sustained that euro strength. This aspect may be not yet fully price in and can weight significantly on the EUR/USD exchange rate. So if ECB will deliver negative rates that may automatically trigger some risk and drive the EUR lower.

The only question that remains unanswered is whether or not ECB will engage in an aggressive quantitative easing campaign which at this point is unlikely.

Best Regards,

Daytrader21