Dears,

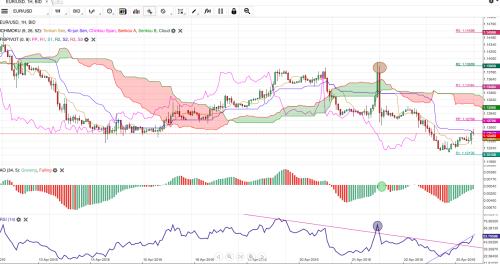

Dears,Monday, new week, but only one event will drives pait this week FED interest rate decion, while other will be juts disturbance on chart, still what to trade. Now we are 1.1250/60 level which seems resistance wich could probably will reamain unbroken today, as generally trend is bearish. On 1H chart we are under 50 sma , toching KS on Ichimoku , but not breaking it, which could be good entry point of sell now.

While RSI shows break up from last week, which could indicate the bulls movement. Which is not supporting previous bearish indications.

Generally with mixed signals today I do expect trade in rather narrow range where with given resistance support expected at 1.122 level, or even below, which rather depends from US Hose sales data, while at the same time negative GER IFU data did not moved pair down, but kept looking up, which could indicate despite all indicators markets willingnes to move up. With all that mess which said, trade expected sideway in narrow range, therefore for today patience is key word.

Have a nice trades!