orex news for years trading on April 4, 2016:

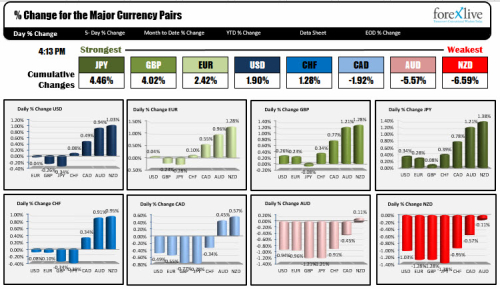

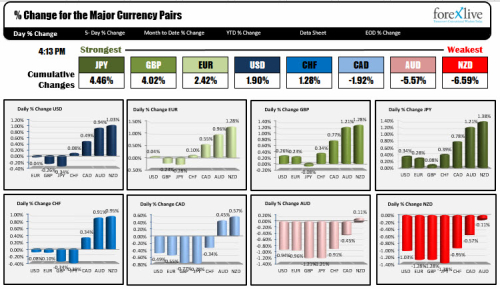

For the greenback, the day ended mixed with the dollar doing better against the commodity currencies and marginally worse against the JPY and GBP. Versus the EUR and the CHF, it was little changed.

As far as fundamental news today, US Factory orders fell by -1.7% (est -1.7%). Durable goods orders were revised lower to -3.0% from -2.8%. The March NY ISM fell to 50.4 from 54.1. From Fed speak today, Boston Fed's Rosengren said that hike more likely than market currently expects.

The USDJPY might typically find a bid off such comments, but traders yawned and then sold the USDJPY to session lows and to the lowest trading level since March 18th (bottomed at 111.11. The pair has pretty good support against the 110.96-111.03 area. Getting within 8 pips of the top part of that support was close enough for some trader today. The pair is closing the day near 111.30.

The RBA will meet and announce their most recent decision in the new trading day. The AUD - coming off weaker retail sales yesterday - is ending the day near the low of the day and below the 100 hour MA which is up at 0.76528 (current price is at 0.7603). The pair did find support against the Friday low at 0.7596 area. The 200 hour MA comes in at 0.7589. A move below that level will be eyed for bearish clues through the interest rate decision. On the topside, a move above the 0.7628 and then the 100 hour MA at 0.76528 would be more bullish from a technical perspective.

Greg Michalowski

- US stocks end the day down on the day with modest losses

- The biggest mover today? GBPNZD has the biggest % change on the day

- Crude oil trades at session lows

- Forex VIDEO: USDJPY tests support area near 111.00 level

- Friday's Non-farm payrolls competition winner was...

- Schaeuble weighs in to Panama scandal

- Negative rates is key top reducing the francs appeal says SNB's Jordan

- Forex technical analysis: AUDUSD moves lower ahead of RBA decision

- Rosengren gives the buck a shot in the arm but that doesn't save USDJPY

- US labour indicators drop in March

- Fed's Rosengren: Hike more likely than market currently expects

- February 2016 US factory orders -1.7% vs -1.7% exp m/m

- ECB QE count: Bought €8.759bn vs €10.345bn prior

- March 2016 ISM New York 50.4 vs 54.1 exp

- China needs clear timely communication on policies - IMF

- Saudi's squeezing Iran as the fight for market share heats up

- Goldman Sachs says sell Asia FX

For the greenback, the day ended mixed with the dollar doing better against the commodity currencies and marginally worse against the JPY and GBP. Versus the EUR and the CHF, it was little changed.

As far as fundamental news today, US Factory orders fell by -1.7% (est -1.7%). Durable goods orders were revised lower to -3.0% from -2.8%. The March NY ISM fell to 50.4 from 54.1. From Fed speak today, Boston Fed's Rosengren said that hike more likely than market currently expects.

The USDJPY might typically find a bid off such comments, but traders yawned and then sold the USDJPY to session lows and to the lowest trading level since March 18th (bottomed at 111.11. The pair has pretty good support against the 110.96-111.03 area. Getting within 8 pips of the top part of that support was close enough for some trader today. The pair is closing the day near 111.30.

The RBA will meet and announce their most recent decision in the new trading day. The AUD - coming off weaker retail sales yesterday - is ending the day near the low of the day and below the 100 hour MA which is up at 0.76528 (current price is at 0.7603). The pair did find support against the Friday low at 0.7596 area. The 200 hour MA comes in at 0.7589. A move below that level will be eyed for bearish clues through the interest rate decision. On the topside, a move above the 0.7628 and then the 100 hour MA at 0.76528 would be more bullish from a technical perspective.

Greg Michalowski