hello everyone,,

Are the USD bulls back in town? The final 24 hours of trading last week certainly gave that impression. While I’m not quite ready to sink into the idea entirely, I am leaning on USD strength as part of my trading plan for the upcoming week.

That said, keep in mind that Monday is a holiday for many countries including the US so volume is expected to be on the lighter side to start the week.

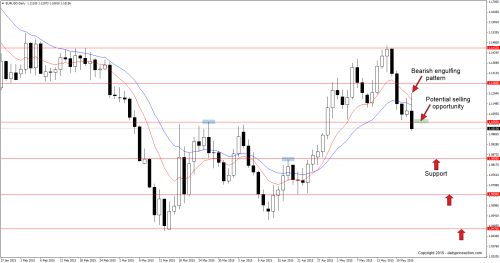

The first pair we’re going to look at is EURUSD. After a four-week rally that lifted the Euro nearly 1,000 pips against the greenback, EURUSD looks ready to continue the downtrend that began one year ago.

Last week the pair failed to break the 1.1452 handle, a level that can be seen influencing price as far back as 1997. After a 380 pip decline between Monday and Wednesday it looked as though the 1.1050 level might attract enough buyers to keep the pair afloat for a bit longer.

But the bears had different plans as they managed to push the market below the key level before the close. This late-week push did more than just break a key level of support. It formed a bearish engulfing pattern with room to run.

From here EURUSD looks ready to revisit the 1.0850 level in the coming week – a price last seen on April 24th. Of course with the banks on holiday on Monday we may not see any significant movement until Tuesday’s session.

Summary: Wait for a retest of the 1.1050 area. Such a retest could present a favorable selling opportunity. Key support comes in at 1.0850, 1.0658 and 1.0470.

thank you all

---------------------

source

Are the USD bulls back in town? The final 24 hours of trading last week certainly gave that impression. While I’m not quite ready to sink into the idea entirely, I am leaning on USD strength as part of my trading plan for the upcoming week.

That said, keep in mind that Monday is a holiday for many countries including the US so volume is expected to be on the lighter side to start the week.

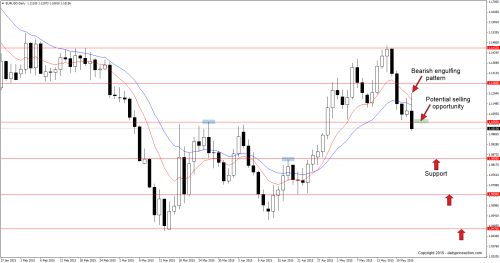

The first pair we’re going to look at is EURUSD. After a four-week rally that lifted the Euro nearly 1,000 pips against the greenback, EURUSD looks ready to continue the downtrend that began one year ago.

Last week the pair failed to break the 1.1452 handle, a level that can be seen influencing price as far back as 1997. After a 380 pip decline between Monday and Wednesday it looked as though the 1.1050 level might attract enough buyers to keep the pair afloat for a bit longer.

But the bears had different plans as they managed to push the market below the key level before the close. This late-week push did more than just break a key level of support. It formed a bearish engulfing pattern with room to run.

From here EURUSD looks ready to revisit the 1.0850 level in the coming week – a price last seen on April 24th. Of course with the banks on holiday on Monday we may not see any significant movement until Tuesday’s session.

Summary: Wait for a retest of the 1.1050 area. Such a retest could present a favorable selling opportunity. Key support comes in at 1.0850, 1.0658 and 1.0470.

thank you all

---------------------

source