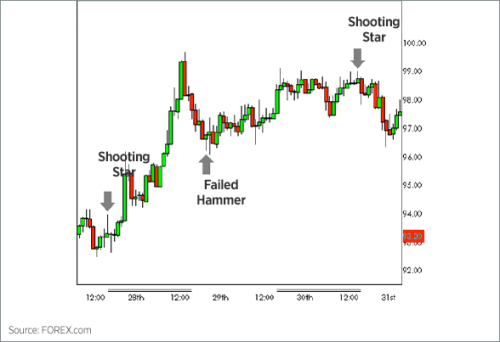

In this daily chart we can observe two things.

One, that observing certain signs of technical analysis, we are close to a rebound within a downtrend looking for the top of the resistance of that trend.

This signal is accompanied by a divergence with the MACD indicator Moving Averages.In addition we can see how the volume has increased in the last 3 sessions, which usually indicates a one-way momentum, or a trend change, as these new market operators, or they unbalance the market forces in an indecision situation (as is happening now ), or they add to the existing trend which would give an even greater boost.

The other, as it is indicated in the circle, the key could give the possible figure that is forming;

if it is finally a Dragonfly Doji, we would be facing a rebound looking for the top of the resistance near the 0.97000; and if it is finally a hammer we would probably see the pair of currencies looking for the support near 0.94750, to bounce towards the top.

Our entry order would be 0.95650 with target at 0.94900; stop loss 0.95950.

If the next order is confirmed in this currency pair it would be in the opposite direction with entry near the support, and target 50% of the distance to the resistance.

Dragonfly Doji:

Hammer:

Good trading

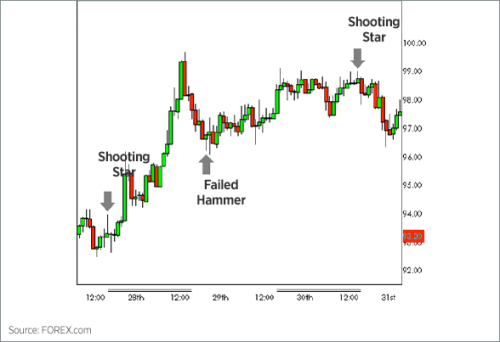

One, that observing certain signs of technical analysis, we are close to a rebound within a downtrend looking for the top of the resistance of that trend.

This signal is accompanied by a divergence with the MACD indicator Moving Averages.In addition we can see how the volume has increased in the last 3 sessions, which usually indicates a one-way momentum, or a trend change, as these new market operators, or they unbalance the market forces in an indecision situation (as is happening now ), or they add to the existing trend which would give an even greater boost.

The other, as it is indicated in the circle, the key could give the possible figure that is forming;

if it is finally a Dragonfly Doji, we would be facing a rebound looking for the top of the resistance near the 0.97000; and if it is finally a hammer we would probably see the pair of currencies looking for the support near 0.94750, to bounce towards the top.

Our entry order would be 0.95650 with target at 0.94900; stop loss 0.95950.

If the next order is confirmed in this currency pair it would be in the opposite direction with entry near the support, and target 50% of the distance to the resistance.

Dragonfly Doji:

Hammer:

Good trading