Today I want to take my time and give a full explanation for my last, two profitable trades, EUR/NZD and GBP/NZD. I took a long position in both of this pairs, Wednesday 18 December, in the morning before the Fed taper decision. For me this trade was more a kind of "synthetic" (not per se) trade. I was expecting NZD dollar to weaken and therefore I was looking in the crosses to maximize my profits as I knew they will be moving much more than NZD/USD.

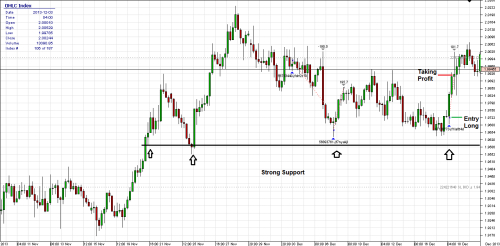

In Figure 1 you can see the 4h GBP/NZD chart and it can been seen that at that time we were near strong support zone. Although we haven't touched that support zone you can see that we had a strong bullish candle (comparing with the other candles, see red dot) which signaled that the buyers are already in the market so few hours later after I saw that the upside momentum was holding the price up quite well I decided to enter a long position. My TP would have been hit but I just wanted to book the profits ahead of Fed tapering decision, because I was expecting a big whipsaw and wanted to protect may capital.

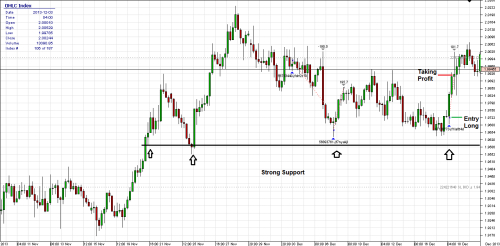

In Figure 2 you can see the 1H EUR/NZD chart, and the same as it was the case with GBP/NZD basically it was a trade correlation, and it can been seen that EUR/NZD was also trading at big support level, and it was supportive for my view that NZD dollar should weaken. I choose to take profits right before the Fed tapering decision, and as it can been seen it was the right decision because the market reversed strongly after the Fed decided to taper.

This two trades combined give me 246 pips in less than 19 hours and boosted my equity balance, and overall I was satisfied with the outcome.

Best regards,

Daytrader21.

- Figure 1. GBP/NZD 4h chart.

In Figure 1 you can see the 4h GBP/NZD chart and it can been seen that at that time we were near strong support zone. Although we haven't touched that support zone you can see that we had a strong bullish candle (comparing with the other candles, see red dot) which signaled that the buyers are already in the market so few hours later after I saw that the upside momentum was holding the price up quite well I decided to enter a long position. My TP would have been hit but I just wanted to book the profits ahead of Fed tapering decision, because I was expecting a big whipsaw and wanted to protect may capital.

- Figure 2. EUR/NZD 1H chart.

In Figure 2 you can see the 1H EUR/NZD chart, and the same as it was the case with GBP/NZD basically it was a trade correlation, and it can been seen that EUR/NZD was also trading at big support level, and it was supportive for my view that NZD dollar should weaken. I choose to take profits right before the Fed tapering decision, and as it can been seen it was the right decision because the market reversed strongly after the Fed decided to taper.

This two trades combined give me 246 pips in less than 19 hours and boosted my equity balance, and overall I was satisfied with the outcome.

Best regards,

Daytrader21.