Good Morning All;

we'll see a new weekly Outlook.

#EnjoyReading

we'll see a new weekly Outlook.

#EnjoyReading

US

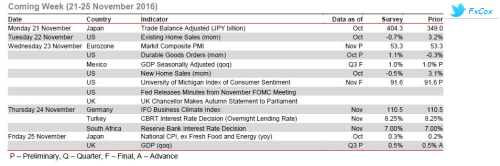

US housing data released next week is expected to show continuing robustness in the sector, supported by a favourable economic backdrop and low financing costs. October existing home sales are expected to dip by 0.7% mom, although this comes after an exceptionally strong September (+3.2%), leaving the seasonally adjusted annualised rate (SAAR) at 5.44 million, in line with the six-month moving average. Similarly, October new home sales are expected to moderate, declining 0.5% mom from 3.1% in the prior month, although maintaining the SAAR at around the 590,000 level.

The release of the Fed’s minutes from its November Federal Open Market Committee (FOMC) meeting could shed some further clues concerning the debate among FOMC members on the timing of the next rise in US interest rates, although given the recent strengthening of US economic data and rising inflationary pressures, the market is now almost fully pricing in a 25bp December rate hike. Therefore, more attention may be placed on any discussions regarding the subsequent pace of the hiking cycle.

Europe

The preliminary eurozone PMIs for November are expected to remain stable, with the composite indicator remaining at 53.3. The eurozone economy remains supported by growth in employment, subdued inflation and low financing costs, while the recent sharp decline in the euro versus the US dollar may have boosted manufacturing new orders. However, uncertainty following the election of Donald Trump as US president could have weighed on sentiment in the region.

The German Ifo Business Climate Index is also expected to remain stable at 110.5 in November, and any further gain in the expectations component (which hit a two-and-a-half year high in October) bodes well for GDP prospects going into 2017.

The second estimate of UK Q3 GDP growth is expected to be unrevised at 0.5% qoq (+2.3% yoy). However, soft industrial production and construction prints for September could see a small downward revision, especially if the September index of services disappoints (released alongside this estimate and expected at +0.2% mom). The breakdown of GDP by expenditure is likely to show the consumer sector doing the heavy lifting in supporting UK growth. It will also be interesting to see how well business investment held up during the quarter amid Brexit-related uncertainty.

The highly anticipated UK Autumn Statement is expected to result in a modest fiscal stimulus in response to the Brexit uncertainty shock, focussed increase in infrastructure spending and help for working families. However, a “fiscal splurge” is unlikely given the recent robustness of UK activity data, higher expected inflationary pressures and an anticipated increase in public sector borrowing requirements (amid lower GDP growth and tax receipts).

Japan and emerging markets

In Japan, CPI ex-fresh food and energy for October is expected to come in slightly stronger than in September, at 0.3% yoy (0.2% previously) on the back of a moderate depreciation of the yen in October and some positive signals in the leading indicator for core inflation in the region of Tokyo. However, Q3 national accounts data showed persistent weakness in private domestic demand, particularly consumption, which limits the potential of a significant near-term rebound in core inflation. Headline CPI is expected to rebound from -0.5% yoy in September to 0.0% in October.

The final estimate of Mexico Q3 GDP growth is expected to be confirmed at 1.0% qoq (+2.0 yoy), supported by the services sector (boosted by rapid credit growth, higher remittances and a strong labour market), while the manufacturing sector remains a drag amid weakness in US industrial demand (hitting exports) and declining domestic oil production due to low investment in the sector.

The Central Bank of Turkey is expected to keep all interest rates unchanged at its November policy meeting. At its October meeting, in contrast to market expectations of a 25bp overnight lending rate cut, Turkey’s central bank kept rates on hold, held back by the recent underperformance of the lira. The bank will likely avoid rate hikes as long as possible due to the sharp slowdown in economic activity after the coup attempt. Yet, should the depreciation pressure on the lira accelerate towards the meeting, the bank may increase the benchmark (one-week) repo rate by 25bps to 7.75%.

Market Moves

US stocks gained amid upbeat macro data and higher oil prices as Trump-rally cools; Japan’s Nikkei boosted by a weaker yen

In the US, the S&P 500 Index booked its second consecutive weekly gain (+0.8%). While investors continued to assess the outlook for US policy under a Trump administration, a string of positive macro data (such as upbeat retail sales for October) and higher oil prices lifted risk appetite. As a result, consumer discretionary stocks were among the best performers and energy producers snapped a two-week losing streak.

European equities struggled to make significant gains this week as the Trump-rally faded. Bourses swung between gains and losses, with the regional EURO STOXX 50 Index ending little changed (-0.3%). Large losses in telecom and utilities hit Spain’s IBEX 35 (-0.2%), while the UK’s FTSE 100 Index outperformed (+0.7%), thanks to a rally in financial stocks and positive contributions from the energy and consumer discretionary sectors, respectively boosted by higher oil prices and much better than expected UK retail sales data for October.

In Asia, Japanese stocks rallied over the week (the Nikkei 225 Index was up +3.4%) as the yen weakened against the US dollar and its peers, boosting the outlook for exporters’ earnings, and after data showed the Japanese economy expanded more than expected in Q3. Philippine stocks posted a 1.3% weekly gain after the country’s Q3 GDP print surprised to the upside. Elsewhere, most markets finished lower as Fed Chair Janet Yellen’s congressional testimony reinforced expectations of a December rate hike and as investors continued to gauge the potential adverse impact of US president-elect Donald Trump’s policy agenda. Indian stocks underperformed (the SENSEX 30 Index was down -2.5%), with investors continuing to assess the near-term economic impact of the government’s recall of high-denomination currency notes.

Regards All.