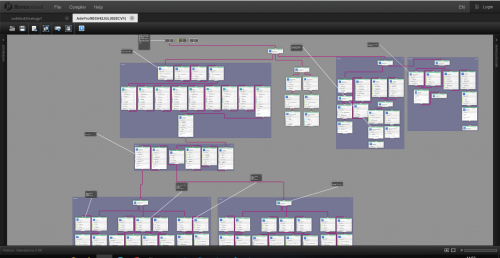

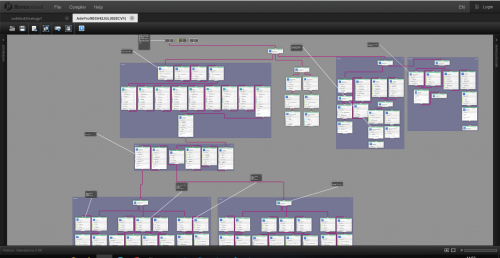

AdvProftBSV42JUL2022CV1 using PVSRA strategy lines to get the signal to open new positions.

I work on this strategy for 2 years and a half, my starting idea was to create an automated strategy to avoid the emotional feelings when I trade. Was archive, in this period based on the rules for the contest, I change my approach to trading and this help me to learn risk and management in my live trades, after 3 years to trade only now I few confident enough to know how to analyze the chart, plan and wait to open a position following my strategy and avoid emotional pain when I lose money. Win this contest sound like a recovery from my all mistakes in my live account, but all these mistakes help me to understand and learn how to trade properly. For those who start or be on this journey I only can to say, don’t give-up even when is hardest and emotionally painful. I want to say thanks to Dukascopy because the contest is educational too, and all videos that we have in Youtube helped and develop our strategy.

About the strategy, the signals are acquired using RSI, ATR, and SMA (200, 50, 20, 10) to define the trend and be the base to set SL and TP, the amount to trade is defined by equity percentage (above >= 2% ) should be set as a parameter. When equity is below the start equity this strategy will use a fixed TP (20 PIPS), and the SL remains the same based on ATR. To improve the strategy I starting to use custom trailing in my SL, this help to not close in loss after reaching 30 pips, it looks like a breakeven, but continuous following the trade every each 5 pips until reaching the TP or the price reverse and reach the stop loss.

I had registered the biggest drawdown , when run on a test environment, then you can be expected 80% or more over the equity can be drawn down. The strategy will stop when equity is equal to 10 times the start equity.

Copyright claiming: This strategy is covered by Strategy Disclosure Policy from Dukascopy on 26052022.

I work on this strategy for 2 years and a half, my starting idea was to create an automated strategy to avoid the emotional feelings when I trade. Was archive, in this period based on the rules for the contest, I change my approach to trading and this help me to learn risk and management in my live trades, after 3 years to trade only now I few confident enough to know how to analyze the chart, plan and wait to open a position following my strategy and avoid emotional pain when I lose money. Win this contest sound like a recovery from my all mistakes in my live account, but all these mistakes help me to understand and learn how to trade properly. For those who start or be on this journey I only can to say, don’t give-up even when is hardest and emotionally painful. I want to say thanks to Dukascopy because the contest is educational too, and all videos that we have in Youtube helped and develop our strategy.

About the strategy, the signals are acquired using RSI, ATR, and SMA (200, 50, 20, 10) to define the trend and be the base to set SL and TP, the amount to trade is defined by equity percentage (above >= 2% ) should be set as a parameter. When equity is below the start equity this strategy will use a fixed TP (20 PIPS), and the SL remains the same based on ATR. To improve the strategy I starting to use custom trailing in my SL, this help to not close in loss after reaching 30 pips, it looks like a breakeven, but continuous following the trade every each 5 pips until reaching the TP or the price reverse and reach the stop loss.

I had registered the biggest drawdown , when run on a test environment, then you can be expected 80% or more over the equity can be drawn down. The strategy will stop when equity is equal to 10 times the start equity.

Copyright claiming: This strategy is covered by Strategy Disclosure Policy from Dukascopy on 26052022.