Read full report here.

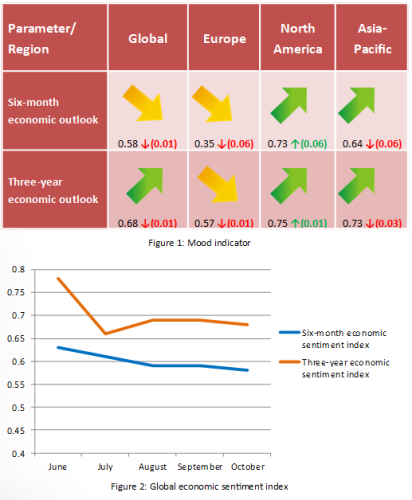

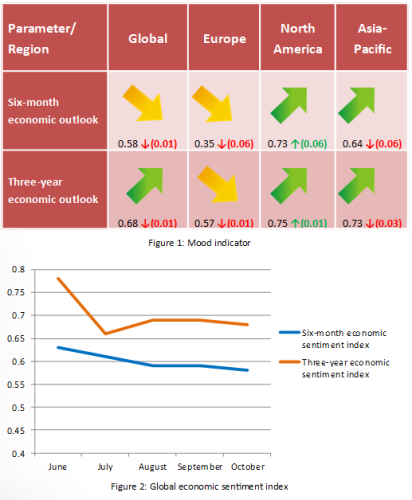

- Intensifying blow of disinflation winds, with major world economies experiencing slowing inflation rate, never-ending streak of negative news from the Euro zone, slowing growth in China, the world’s second biggest economy, and recent volatility in financial markets seemed to be the main reasons behind experts’ gloomier outlook for the global economy in October. Both short and long term world’s economic sentiment indexes fell marginally from the previous month.

- While the continental Europe continues to post uneven economic indicators, concerns are rising about health of the leading Euro area’s economies, including Germany and France, in the UK debates among Bank of England rate-setters get hotter, as they weigh when to start tightening cycle by raising interest rates amid rapidly improving economic conditions in the country. Nevertheless, upbeat news from Britain was not able to offset the effect which the Euro zone disappointing data had on academic experts. As a result, both sentiment indexes dropped in October.

- In the US, economic performance is improving at a rapid pace, which is definitely beneficial for its neighbor Canada. The Fed has finally completed its six-year old quantitative easing programme despite the recent turbulence in financial markets as well as global economic woes. Professors’ faith in the North American region strengthened in the month of October, as both six-month and three-year sentiment indexes climbed.

- Asia-Pacific saw its sentiment gauges falling in October, as China’s economy slows somewhat, Japan reaps the fruits of sales tax hike, central bankers in Australia and New Zealand monitor economic developments vigorously to understand the risk from falling commodity prices to the economy.